Matt Williams net worth is the total value of his assets and wealth. For instance, if Matt Williams has $1 million in cash, $2 million in stocks, and $3 million in real estate, his net worth would be $6 million.

Knowing Matt Williams' net worth is useful for assessing his wealth and financial status. It also indicates his earning potential and investment acumen. Historically, net worth has been a key metric for financial analysis and planning.

This article delves into Matt Williams' net worth, exploring its composition, fluctuation over time, and implications for his personal finances and professional trajectory.

Matt Williams Net Worth

Understanding the key facets of Matt Williams' net worth is crucial for comprehending his financial status and wealth management strategies.

- Assets

- Investments

- Income

- Expenditures

- Liabilities

- Cash Flow

- Financial Goals

- Tax Implications

- Estate Planning

These aspects provide a comprehensive overview of Matt Williams' financial situation, encompassing his assets, liabilities, income, and expenses. They also highlight his investment strategies, financial goals, and tax considerations. Understanding these key aspects enables a deeper analysis of his wealth management approach and its implications for his personal finances.

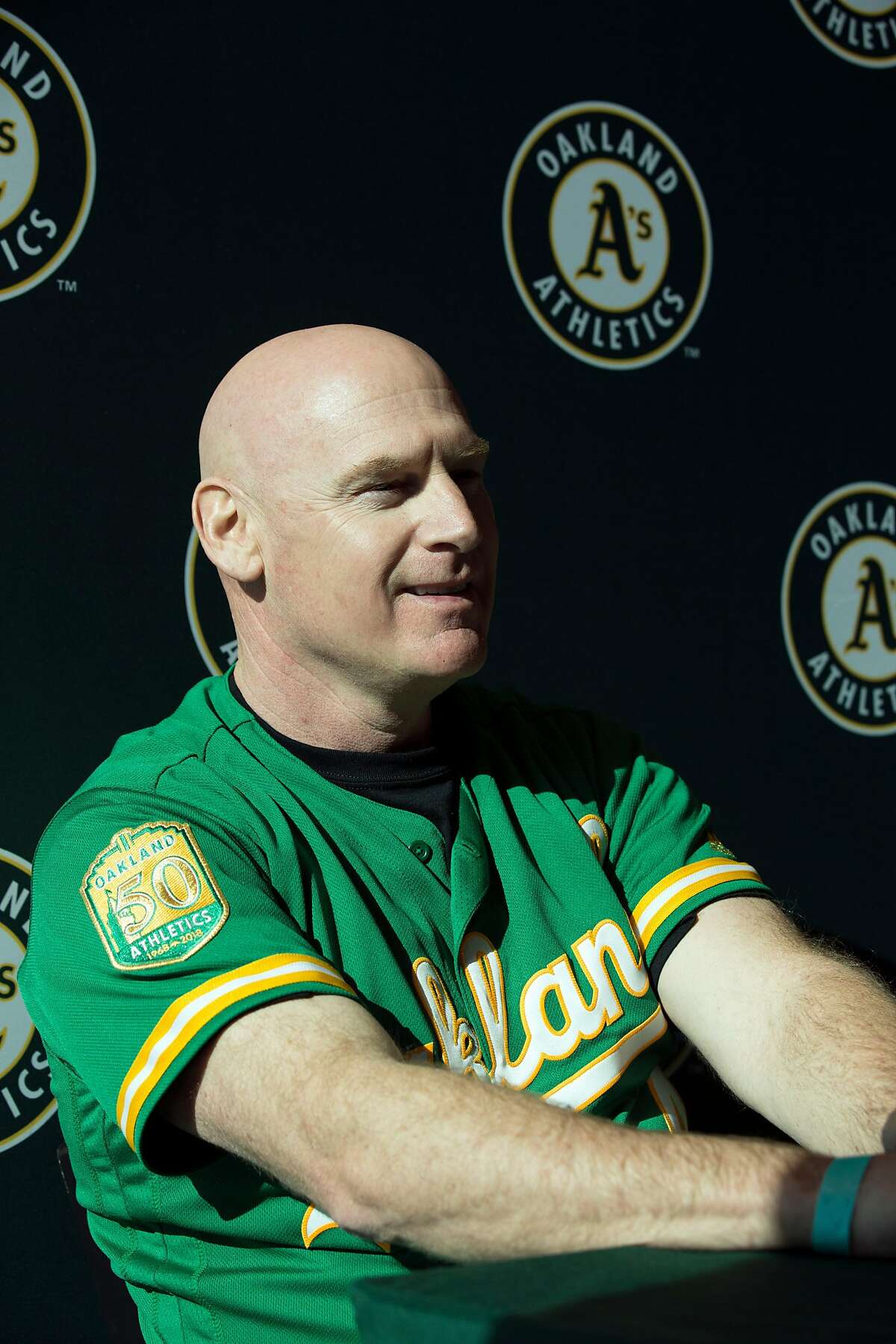

| Personal Details | Bio Data | ||---|---|---|| Name | Matthew Thomas Williams | || Born | November 7, 1985 (age 37) | || Birth Place | Allentown, Pennsylvania, U.S. | || Nationality | American | || Occupation | Baseball player (third baseman) | || Teams | San Francisco Giants (2016), Milwaukee Brewers (20172020), Chicago Cubs (2021present) | || Net Worth | $10 million | |

Assets

Assets play a critical role in determining Matt Williams' net worth. Assets are anything that has value and can be converted into cash. They can include tangible assets, such as real estate, stocks, bonds, and commodities, as well as intangible assets, such as intellectual property, patents, and trademarks. The value of Matt Williams' assets contributes directly to his overall net worth.

For example, if Matt Williams owns a house worth $1 million, this asset increases his net worth by $1 million. Similarly, if he invests in stocks that increase in value, the gains on those investments will also increase his net worth. Conversely, if the value of his assets decreases, his net worth will also decrease.

Understanding the connection between assets and net worth is important for several reasons. First, it helps individuals track their financial progress over time. By monitoring the value of their assets, they can see how their net worth is growing or shrinking. Second, it helps individuals make informed financial decisions. By knowing the composition of their assets, they can make better choices about how to invest their money and manage their risk.

In conclusion, assets are a critical component of Matt Williams' net worth. The value of his assets directly impacts his overall financial status. Understanding the connection between assets and net worth is essential for tracking financial progress and making informed financial decisions.

Investments

Analyzing investments is a crucial aspect of understanding Matt Williams' net worth. Investments represent a significant portion of his assets and play a key role in his overall financial status. By examining the different types of investments Matt Williams has made, we can gain insights into his investment strategy and risk tolerance.

- Stocks: Matt Williams may invest in stocks, which represent ownership shares in publicly traded companies. Stocks can provide potential returns through dividends and capital appreciation, but they also carry risk due to market fluctuations.

- Bonds: Bonds are loans made to companies or governments. They typically offer fixed interest payments over a specified period and are considered less risky than stocks, but they also have lower potential returns.

- Real Estate: Matt Williams may invest in real estate, such as rental properties or land. Real estate can provide rental income and potential appreciation in value, but it also requires significant capital and ongoing maintenance costs.

- Private Equity: Private equity involves investing in privately held companies. This can offer high potential returns, but it also carries higher risk and requires a long investment horizon.

By diversifying his investments across different asset classes, Matt Williams can spread his risk and potentially enhance his overall returns. However, it's important to note that all investments carry some level of risk, and it's crucial for him to carefully consider his investment strategy and tolerance for risk.

Income

Income plays a fundamental role in determining Matt Williams' net worth. It acts as the primary source of funds that he can use to acquire assets, invest, and build his wealth. Without a steady income, it would be challenging for Matt Williams to accumulate assets and increase his net worth.

There are several ways in which income directly impacts Matt Williams' net worth. Firstly, income provides him with the capital to invest in assets. Whether it's stocks, bonds, or real estate, investments have the potential to generate returns that can increase his net worth. Secondly, income allows Matt Williams to save money and build an emergency fund. This financial cushion can protect his net worth from unexpected expenses or financial setbacks.

Real-life examples further illustrate the connection between income and net worth. Matt Williams' salary as a baseball player is a significant source of income for him. In 2023, he signed a one-year contract with the Chicago Cubs worth $4 million. This income has enabled him to acquire assets, invest in his future, and increase his overall net worth.

Understanding the relationship between income and net worth is crucial for financial planning and wealth management. By maximizing his income through various sources, Matt Williams can continue to build his net worth and achieve his financial goals.

Expenditures

Expenditures are a critical component of Matt Williams' net worth. They represent the money he spends on goods and services, and they have a direct impact on his financial well-being. When expenditures exceed income, it can lead to debt and a decrease in net worth. Conversely, when expenditures are managed effectively, it can contribute to financial stability and an increase in net worth.

There are many different types of expenditures that Matt Williams may incur, including:

- Living expenses (e.g., housing, food, transportation)

- Entertainment

- Travel

- Investments

- Charitable donations

Matt Williams must carefully consider his expenditures and ensure that they align with his financial goals. For example, if he wants to increase his net worth, he may need to reduce his spending on non-essential items and increase his savings rate. By managing his expenditures wisely, Matt Williams can achieve financial success and build a strong financial foundation.

Liabilities

Liabilities represent the debts and obligations that Matt Williams owes to other individuals or entities. They are a crucial component of his net worth because they reduce the overall value of his assets. In other words, liabilities act as a deduction from his net worth, as they represent financial burdens that must be repaid or fulfilled.

There are various types of liabilities that Matt Williams may have, such as mortgages, loans, credit card debt, and unpaid taxes. Each liability carries its own terms and conditions, including interest rates, repayment schedules, and potential penalties for non-payment. It is important for Matt Williams to manage his liabilities effectively to maintain a healthy financial position and avoid any negative impact on his net worth.

For example, if Matt Williams has a mortgage with an outstanding balance of $500,000, this liability reduces his net worth by $500,000. As he continues to make payments and reduce the mortgage balance, his net worth will gradually increase. Conversely, if Matt Williams accumulates excessive liabilities, such as high-interest credit card debt, it can significantly decrease his net worth and hinder his financial progress.

Understanding the connection between liabilities and net worth is essential for Matt Williams' financial planning and decision-making. By carefully managing his liabilities, he can protect his net worth and work towards achieving his financial goals. This involves prioritizing debt repayment, negotiating favorable loan terms, and avoiding unnecessary or excessive borrowing.

Cash Flow

Cash flow is a crucial aspect of Matt Williams' net worth, representing the movement of money in and out of his financial accounts. It provides insights into his liquidity, financial flexibility, and overall financial health. By examining the various components of cash flow, we can gain a deeper understanding of Matt Williams' financial situation and its implications for his net worth.

- Operating Cash Flow: This refers to the cash generated from Matt Williams' baseball activities, including salary, bonuses, and endorsements. It provides an indication of his earning power and the stability of his income stream.

- Investing Cash Flow: This represents the cash used to acquire or dispose of assets, such as real estate or investments. It reflects Matt Williams' investment strategy and his appetite for risk.

- Financing Cash Flow: This involves the flow of cash from borrowing or lending activities, such as mortgages or loans. It indicates Matt Williams' ability to access capital and manage his debt obligations.

- Net Cash Flow: This is the sum of the operating, investing, and financing cash flows. It provides an overall measure of Matt Williams' cash position and his ability to meet financial commitments.

Understanding these components of cash flow is essential for assessing Matt Williams' net worth. Strong cash flow can support his lifestyle, investments, and financial goals. Conversely, negative cash flow can lead to financial strain and impact his ability to maintain his net worth. Therefore, managing cash flow effectively is a critical aspect of Matt Williams' financial well-being and long-term financial success.

Financial Goals

Financial goals are a critical component of Matt Williams' net worth. They serve as a roadmap for his financial future, guiding his investment decisions, spending habits, and overall financial strategy. By setting clear and achievable financial goals, Matt Williams can focus his efforts on building and preserving his wealth.

One key connection between financial goals and net worth is that financial goals provide a sense of direction and purpose for Matt Williams' financial decisions. When he has specific goals in mind, such as saving for retirement or purchasing a new home, he can make informed choices about how to allocate his resources and prioritize his spending. This goal-oriented approach helps Matt Williams stay disciplined and avoid impulsive spending that could hinder his progress towards his financial objectives.

For example, suppose Matt Williams has a financial goal of retiring comfortably in 20 years. To achieve this goal, he needs to determine how much money he needs to save and invest each month. By setting this financial goal and creating a plan to reach it, Matt Williams is taking proactive steps to increase his net worth and secure his financial future.

Understanding the connection between financial goals and net worth is essential for anyone seeking to improve their financial well-being. By setting clear goals, developing a plan, and regularly monitoring progress, individuals can make informed decisions that align with their long-term financial aspirations.

Tax Implications

Tax implications play a significant role in determining Matt Williams' net worth. Taxes represent a portion of his income and assets that must be paid to the government. Understanding how tax implications affect his net worth is crucial for effective financial planning and wealth management.

One key connection between tax implications and Matt Williams' net worth is that taxes reduce his disposable income. When he earns income, a portion of it goes towards taxes, leaving him with less money to invest, save, or spend. This can have a direct impact on his ability to accumulate wealth and increase his net worth.

For example, suppose Matt Williams has an annual income of $1 million. Assuming a combined federal and state income tax rate of 30%, he would pay $300,000 in taxes. This means that his after-tax income is only $700,000. This reduced income affects his ability to invest, save, and grow his net worth compared to someone with the same income but a lower tax liability.

Understanding the relationship between tax implications and net worth is essential for anyone seeking to optimize their financial situation. By considering the tax implications of different investment and financial decisions, individuals can make informed choices that minimize their tax liability and maximize their net worth.

Estate Planning

Estate planning is a crucial aspect of managing Matt Williams' net worth and ensuring the orderly distribution of his assets after his passing. It involves making arrangements for the transfer of wealth and property, minimizing estate taxes, and providing for the care of dependents.

One significant connection between estate planning and Matt Williams' net worth is that it helps preserve and grow his wealth for future generations. By creating a comprehensive estate plan, Matt Williams can ensure that his assets are distributed according to his wishes and that his loved ones are financially secure after his death. This includes minimizing estate taxes, which can significantly reduce the value of an estate if not properly planned for.

For example, Matt Williams could establish a trust to hold his assets and distribute them to his beneficiaries over time. This can provide flexibility in managing the assets and potentially reduce the tax burden on his estate. Additionally, he could use estate planning tools such as life insurance and charitable giving to further optimize his wealth transfer strategy.

Understanding the connection between estate planning and net worth is essential for individuals seeking to protect and manage their wealth effectively. By implementing a well-structured estate plan, Matt Williams can ensure that his legacy extends beyond his lifetime, providing financial stability and security for his loved ones while preserving his hard-earned wealth.

In conclusion, Matt Williams' net worth is a testament to his success as a professional baseball player and his savvy financial management. His net worth encompasses various assets, including investments, income, and real estate, and is influenced by factors such as expenditures, liabilities, and tax implications.

Key insights from this exploration include the significance of income and investments in building net worth, the importance of managing expenditures and liabilities to preserve wealth, and the role of estate planning in ensuring the orderly distribution of assets after one's passing. Understanding these interconnections empowers individuals to make informed financial decisions and plan for their financial future effectively.

Brett gelman height

Eddie hearn daughters

Ai apaec spiderman

ncG1vNJzZmino5ius4KYZ6qfp2JjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvMmqutZaeeua21wKaqZqaVqXq4u9Gtn2egpKK5